Get moving

Now that you have the low-down on what you can and can’t say about your offering, it’s time to get organized. Your campaign should include marketing materials, social media engagement, email campaigns, videos and perhaps even live presentations. You might want to set aside some money for social media advertising as well. That’s up to you. The more you market, the more eyes on our campaign and the more likelihood of success.

In all probability your campaign won’t be live for more than a few months. It’s important to get organized ahead of time. You can’t market ahead of time if you are using Reg CF, but you can be fully prepared for the starting gun.

There are lots of opinions out there about the optimal this and the optimal that. It can be overwhelming. So we thought we’d share our communications plan with you. We tweak it all the time. It could be a great starting point for you.

What’s our plan?

Marketing materials. This is the beginning. We gather gorgeous photos, images and graphics so that we have an asset library for our marketing campaign, ready to create ads, videos, emails and posts.

Videos. Everyone loves videos. Make a video if it’s in your budget. Nothing tells a story better than a video.

Social media. We use Instagram, Linkedin, Twitter and Facebook. We write a ton of posts and curate a lot of information to support our brand. Sometimes it’s original content and sometimes it’s an article that supports our point of view.

We use Sendible to organize and schedule our posts. In the past we’ve used HootSuite and AgoraPulse. They all have slightly different features, but they all work well. Some of them have free plans. All provide the ability to schedule posts ahead of time. We set aside some time to write twenty posts, then schedule them out for the next few weeks. Rinse and repeat.

Email. We’ve built a subscriber list on MailChimp. You can build one too. Create great-looking email campaigns easily using the marketing materials you have organized. Schedule them just like your social media posts.

Speaking. We speak at conferences, meetups and over donuts and coffee. People appreciate meeting who they are investing in.

Remember, the advertising rules apply to each and every medium you use.

How often?

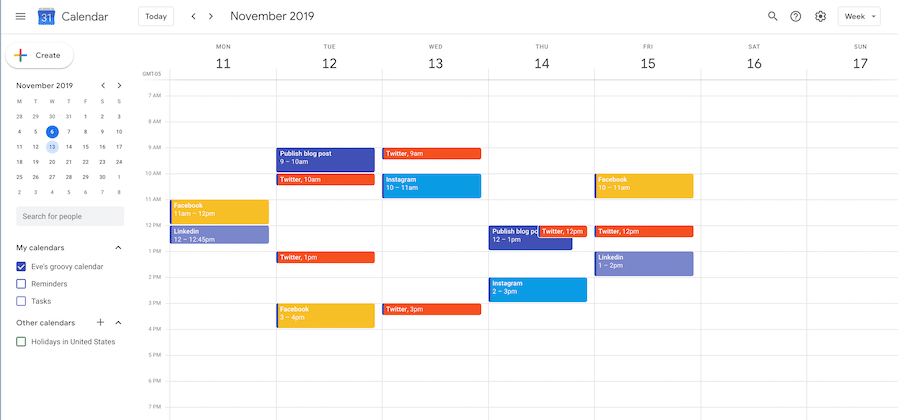

Our posting schedule varies for each social media channel as does our posting style.

Facebook. We post once on Sunday, Tuesday, Friday and Saturday. We mix up the times – 9 am, 1 or 3 pm. Sometimes we tag groups or people with @NAME.

Twitter. We post two to four times every day of the week. We stagger times on any one day and vary times throughout the week. We don’t post earlier than 8 am or later than 7 pm. And we add hashtags.

Linkedin. We post once on Monday, Wednesday and Thursday, at 3, 4 or 5 pm. And we add hashtags

Instagram. We post once a day as many days of the week as we can at no particular time. And we add hashtags.

Email. We email our subscribers no more than one time per week. More than that is an irritation.

Speaking. We take every opportunity to get in front of a live audience.

How do we organize ourselves?

For a short campaign we use a google calendar to get ourselves organized, making sure we check our tasks daily. Or we might use a google sheet. Sometimes we use Asana, our task manager. You can also find fancy social media calendars online. It doesn’t matter what you use. The point is to make a plan and stick to it.

Back to how to market your offering.